Chapters

Introduction to DeFi on Solana

Learn about decentralized finance (DeFi) applications on Solana, including trading, lending, and yield opportunities.

Introduction to DeFi on Solana

Decentralized Finance (DeFi) refers to financial services built on Solana. These applications let you trade, lend, borrow, and earn yield without traditional intermediaries. This chapter introduces the main types of DeFi services available on Solana and how they work.

What You'll Learn

By the end of this chapter, you'll understand:

- What DeFi is and how it differs from traditional finance

- Major types of DeFi applications

- How to evaluate opportunities and risks

- Getting started with DeFi safely

- Common terms and concepts

Understanding DeFi

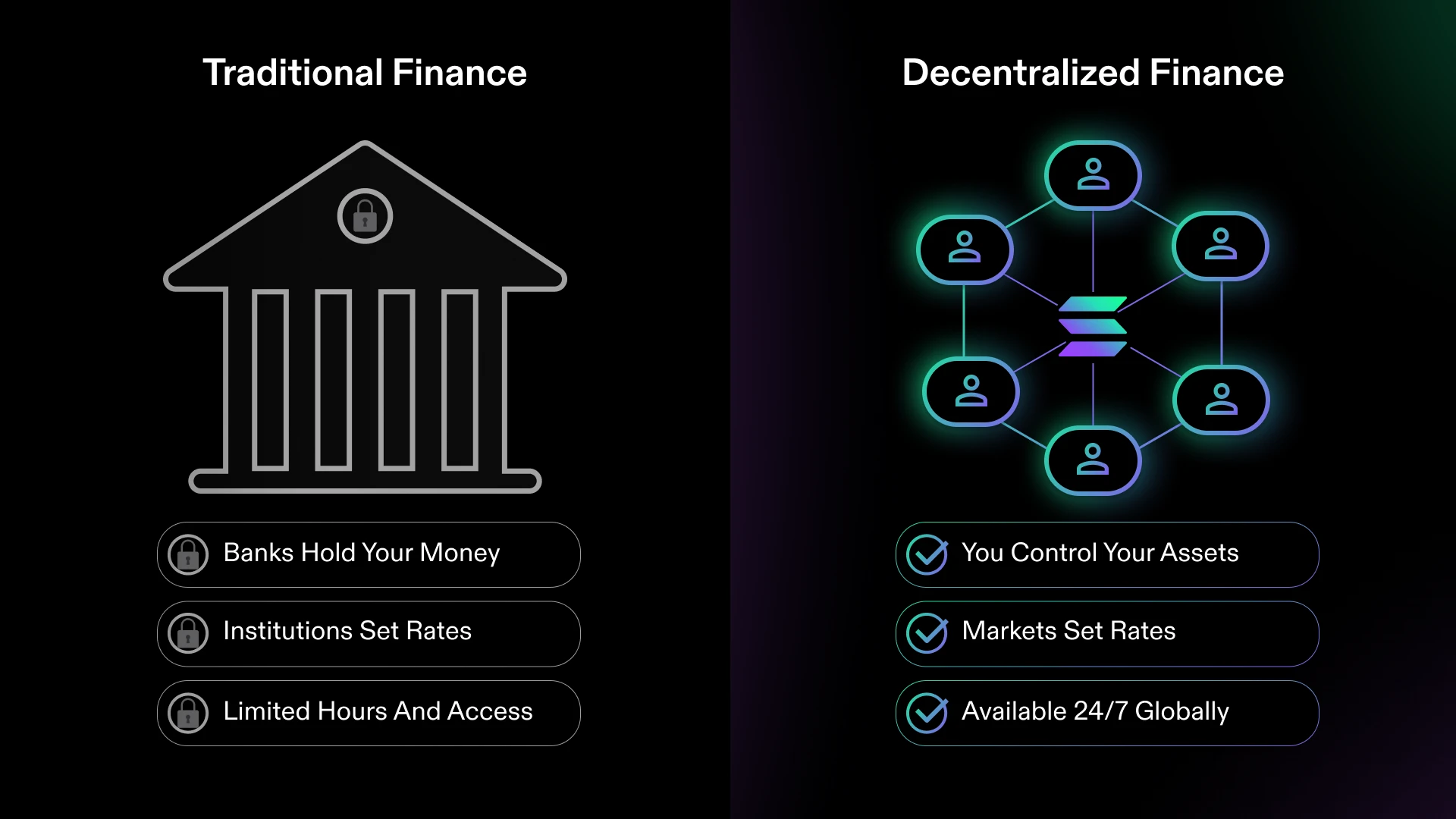

Comparison of Traditional Finance vs Decentralized Finance showing key differences in control, access, and availability

Comparison of Traditional Finance vs Decentralized Finance showing key differences in control, access, and availability

DeFi applications use smart contracts (programs on Solana) to provide financial services:

Traditional Finance

- Banks hold your money

- Institutions set rates

- Limited hours and access

- Geographic restrictions

- Approval processes

DeFi

- You control your assets

- Markets set rates

- Available 24/7 globally

- Open to anyone

- No approval needed

Types of DeFi Applications

Decentralized Exchanges (DEXs)

Trade tokens directly from your wallet without depositing on an exchange.

How they work:

- Smart contracts hold liquidity pools of token pairs

- Traders swap against these pools

- Prices adjust automatically based on supply/demand

- Liquidity providers earn fees

Multiple DEX options exist on Solana with different features and interfaces.

Lending and Borrowing

Earn interest by lending assets or borrow against collateral.

How it works:

- Lenders deposit assets into pools

- Borrowers take loans using collateral

- Interest rates adjust based on utilization

- Everything is overcollateralized for safety

Several established lending protocols operate on Solana.

Yield Farming

Earn rewards by providing liquidity or staking tokens.

Common strategies:

- Provide liquidity to DEX pools

- Stake LP tokens for additional rewards

- Auto-compound earnings

- Combine multiple protocols

Important: Higher yields often mean higher risks

Getting Started with DeFi

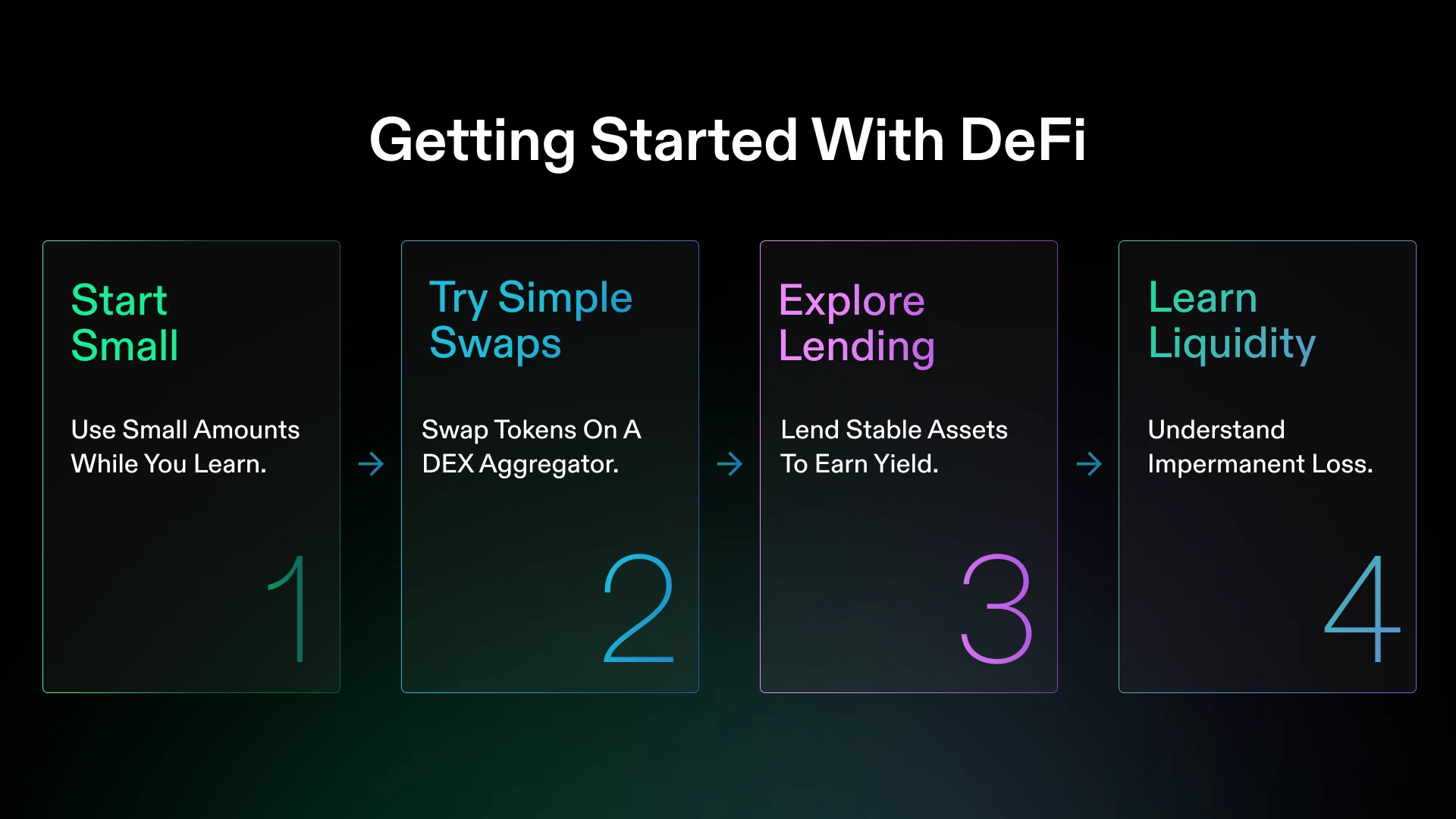

Four-step DeFi journey: Start Small, Try Simple Swaps, Explore Lending, Learn Liquidity

Four-step DeFi journey: Start Small, Try Simple Swaps, Explore Lending, Learn Liquidity

Step 1: Start Small

- Use amounts you can afford to lose while learning

- Understand each step before proceeding

- Keep most funds in your wallet initially

Step 2: Try Simple Swaps

- Visit a DEX aggregator

- Connect your wallet

- Select tokens to swap

- Review the rate and fees

- Confirm the transaction

Step 3: Explore Lending

- Research lending protocols

- Check current interest rates

- Start with stable assets

- Monitor your positions

Step 4: Learn About Liquidity

- Understand impermanent loss

- Start with stable pairs

- Track your returns carefully

Key Concepts to Understand

Annual Percentage Yield (APY)

The yearly return including compound interest. A 10% APY on $1,000 = $100 per year.

Total Value Locked (TVL)

The total amount deposited in a protocol. Higher TVL often indicates more trust but isn't a guarantee of safety.

Impermanent Loss

When providing liquidity, token price changes can result in less value than simply holding. Most significant with volatile pairs.

Slippage

The difference between expected and actual price when trading. Higher for large trades or low liquidity.

Collateralization

Most DeFi loans require collateral worth more than the loan amount, protecting lenders from defaults.

Evaluating DeFi Opportunities

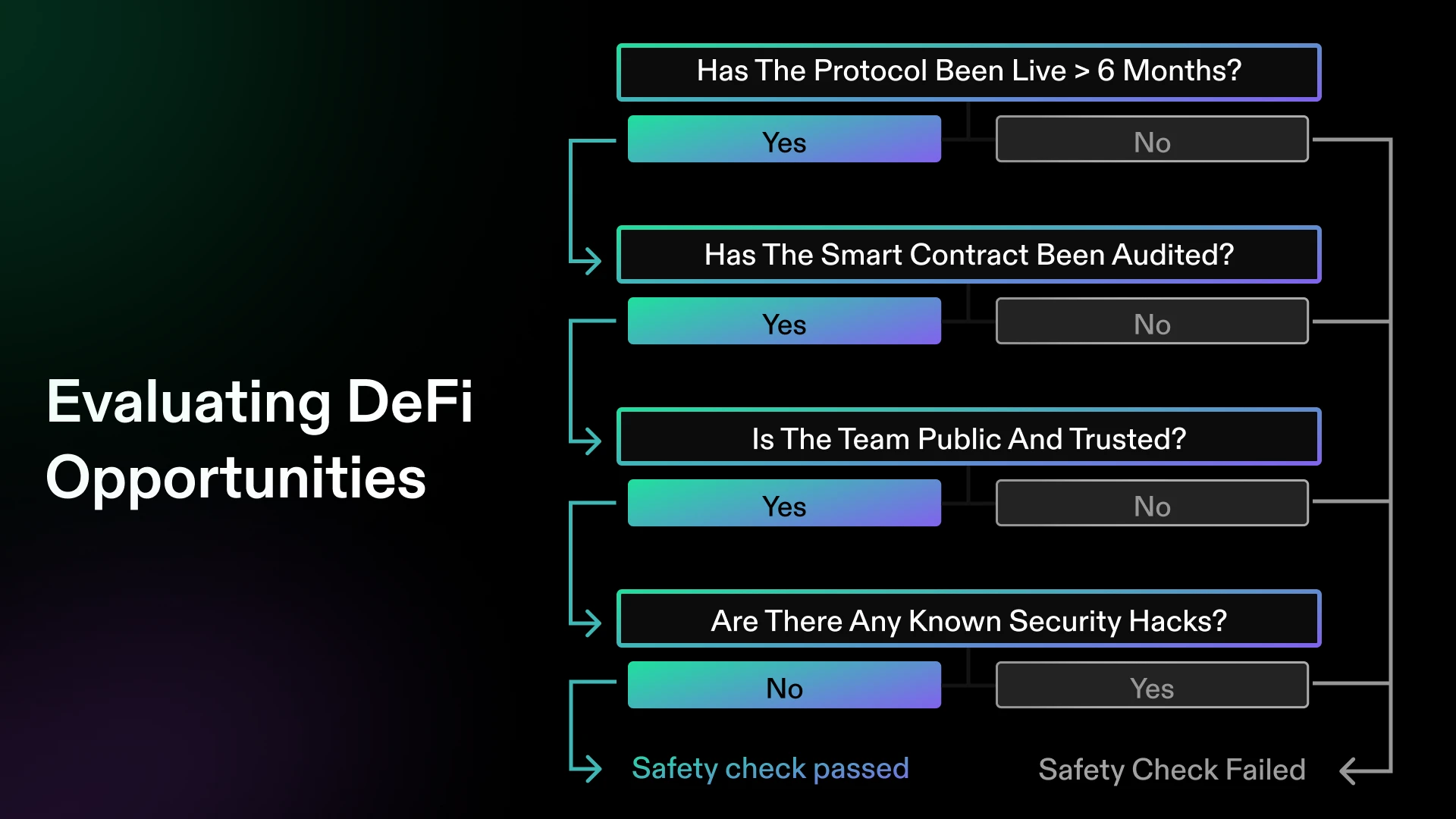

Decision tree for evaluating DeFi protocols: Check if live >6 months, audited, team public, no security hacks

Decision tree for evaluating DeFi protocols: Check if live >6 months, audited, team public, no security hacks

Research Protocol Safety

- How long has it operated?

- Has it been audited?

- What's the team's reputation?

- Check for past incidents

Understand the Risks

- Smart contract bugs

- Market volatility

- Impermanent loss

- Liquidation risks

- New protocol risks

Calculate Real Returns

- Account for all fees

- Consider impermanent loss

- Factor in token price changes

- Compare to simpler alternatives

Safety Best Practices

Start Your DeFi Journey Safely

- Research thoroughly - Understand before you invest

- Start small - Learn with amounts you can afford to lose

- Diversify - Don't put everything in one protocol

- Monitor regularly - DeFi rates and risks change quickly

- Keep records - Track transactions for taxes

Red Flags to Avoid

- Promises of guaranteed returns

- Pressure to invest quickly

- Anonymous teams with no history

- Unrealistically high yields

- Complex strategies you don't understand

Common Questions

Is DeFi safe?

DeFi carries risks including smart contract bugs, market volatility, and user error. Start small and only use established protocols.

How are yields generated?

Yields come from trading fees, borrowing interest, and protocol incentives. Understand the source before investing.

What about taxes?

DeFi transactions may be taxable events. Keep detailed records and consult tax professionals in your jurisdiction.

Can I lose money in DeFi?

Yes. Risks include impermanent loss, liquidations, protocol failures, and market downturns. Never invest more than you can afford to lose.

What's Next

Now that you understand DeFi basics, you're ready to explore specific applications. The next chapter covers the Solana ecosystem in detail, showing you how to discover and evaluate different protocols.

Remember: DeFi offers new opportunities but requires personal responsibility. Take time to learn, start small, and always understand the risks before participating.