Chapters

Introduction to Solana Tokens

Learn about tokens - the different types of digital assets on Solana including stablecoins, wrapped tokens, and project tokens.

Introduction to Solana Tokens

Tokens are digital assets built on Solana. Like how the US dollar is the native currency of the United States, SOL is Solana's native currency. Tokens represent all other assets - from stablecoins like USDC to project tokens and NFTs. This chapter explains how tokens work and what you can do with them.

What You'll Learn

By the end of this chapter, you'll understand:

- What tokens are and how they work on Solana

- Different types of tokens and their uses

- How to manage tokens in your wallet

- Token accounts and fees

- Safety considerations when dealing with tokens

Understanding Tokens on Solana

Solana has two main types of digital assets:

- SOL: The native currency used for transactions and fees

- Tokens: All other digital assets on Solana

Just like apps on your phone follow certain standards to work properly, tokens on Solana follow a common standard that makes them compatible with wallets and applications.

Types of Tokens

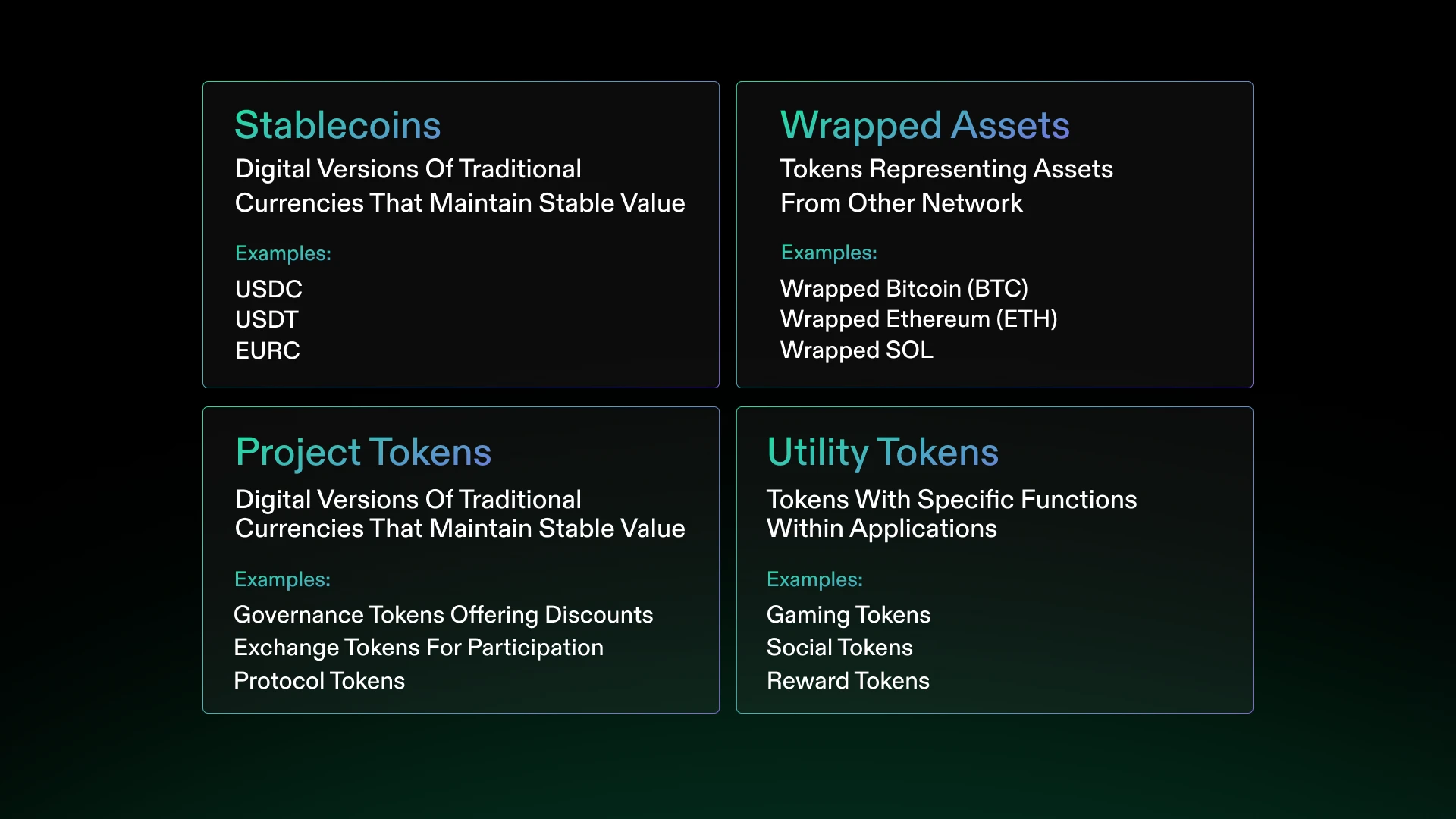

Grid showing four token categories: Stablecoins, Wrapped Assets, Project Tokens, and Utility Tokens with examples

Grid showing four token categories: Stablecoins, Wrapped Assets, Project Tokens, and Utility Tokens with examples

Stablecoins

Digital versions of traditional currencies that maintain stable value.

Examples:

- USDC: Digital US dollars

- USDT: Tether, another USD stablecoin

- EURC: Digital euros

Uses: Saving, payments, trading, avoiding volatility

Wrapped Assets

Tokens representing assets from other networks.

Examples:

- Wrapped Bitcoin (BTC): Bitcoin usable on Solana

- Wrapped Ethereum (ETH): Ethereum on Solana

- Wrapped SOL: Used in some DeFi protocols

Uses: Access other cryptocurrencies with Solana's speed and low fees

Project Tokens

Tokens created by applications and protocols.

Examples:

- Governance tokens for voting on protocol decisions

- Exchange tokens offering fee discounts

- Protocol tokens for ecosystem participation

Uses: Governance voting, fee discounts, rewards

Utility Tokens

Tokens with specific functions within applications.

Examples:

- Gaming tokens for in-game economies

- Social tokens for creator communities

- Reward tokens from protocols

Uses: Access features, earn rewards, participate in ecosystems

How Token Accounts Work

Wallet diagram showing main SOL account and separate token accounts for USDC and WBTC

Wallet diagram showing main SOL account and separate token accounts for USDC and WBTC

Unlike some networks where all assets share one address, Solana uses a token account system:

- Main Wallet: Holds your SOL

- Token Accounts: Separate accounts for each token type

Why Token Accounts?

- Better performance and organization

- Clear separation of different assets

- Efficient network storage

Account Rent

- Each token account requires ~0.002 SOL deposit

- This "rent" is refundable when closing the account

- Prevents spam and funds network storage

- Typically costs $0.20-0.50 per token type

Managing Your Tokens

Receiving Tokens

- Share your wallet address

- Sender initiates transfer

- Wallet creates token account if needed

- Tokens appear in your wallet

Viewing Your Tokens

Modern wallets show:

- Token symbols and logos

- Current balances

- USD values

- Recent transactions

Sending Tokens

- Select token to send

- Enter recipient address

- Choose amount

- Confirm transaction

- Pay small SOL fee (~$0.0005)

Closing Token Accounts

When you no longer need a token:

- Send all tokens out

- Close the account

- Recover the rent deposit

Token Creation Basics

Anyone can create tokens on Solana:

Requirements

- Small amount of SOL for fees (~0.5 SOL)

- Basic token information (name, symbol, supply)

- Optional: logo and metadata

Common Uses

- Community tokens

- Reward systems

- Fundraising

- Gaming economies

- Experimental projects

Important Note

Creating a token doesn't give it value. Value comes from utility, adoption, and market dynamics.

Token Safety

Token safety checklist showing what to check and what to be careful of when dealing with tokens

Token safety checklist showing what to check and what to be careful of when dealing with tokens

Verify Before Trusting

- Check official project websites

- Verify token addresses

- Look for audit reports

- Research the team

Common Scams to Avoid

- Fake tokens: Impersonating popular projects

- Rug pulls: Creators abandoning projects

- Honeypots: Tokens you can buy but not sell

- Pump and dumps: Artificial price manipulation

Best Practices

- Research thoroughly before buying

- Start small with new tokens

- Use reputable sources for token information

- Be skeptical of guaranteed returns

- Check liquidity before large purchases

Working with Tokens

Swapping Tokens

Use DEX aggregators to find the best rates:

- Connect wallet

- Select tokens to swap

- Review rate and fees

- Confirm swap

Checking Token Info

Resources for research:

- Block explorers: View token details and holders

- Price aggregators: Check prices and liquidity

- Official project sites: Verify authenticity

Managing Multiple Tokens

- Organize by hiding zero balances

- Favorite frequently used tokens

- Use portfolio trackers

- Close unused token accounts

Common Questions

Do I need SOL to send tokens?

Yes, all transactions require small SOL fees, even when sending other tokens.

Why do some tokens appear automatically?

Projects can airdrop tokens to wallets. Be cautious of unsolicited tokens.

Can I recover sent tokens?

No, transactions on Solana are permanent. Always double-check addresses.

What determines token value?

Supply and demand, utility, project development, and market sentiment all affect token prices.

What's Next

Now that you understand tokens, you're ready to learn about NFTs - unique digital assets that represent ownership of specific items rather than fungible currencies. The next chapter explores how NFTs work and their various use cases.

Remember: tokens are tools that enable new types of digital economies. Focus on understanding their utility rather than speculation, and always research before investing.