Chapters

What is Staking?

Learn how staking works on Solana, how to earn rewards by helping secure the network, and what to consider when choosing validators.

What is Staking?

Staking is how you can earn rewards by helping secure the Solana network. When you stake your SOL, you're contributing to the network's security while earning approximately 5-7% annual rewards. This chapter explains how staking works and how to get started.

What You'll Learn

By the end of this chapter, you'll understand:

- How staking helps secure the network

- How to stake your SOL and earn rewards

- How to choose validators

- Different staking options available

- Risks and considerations

How Staking Works

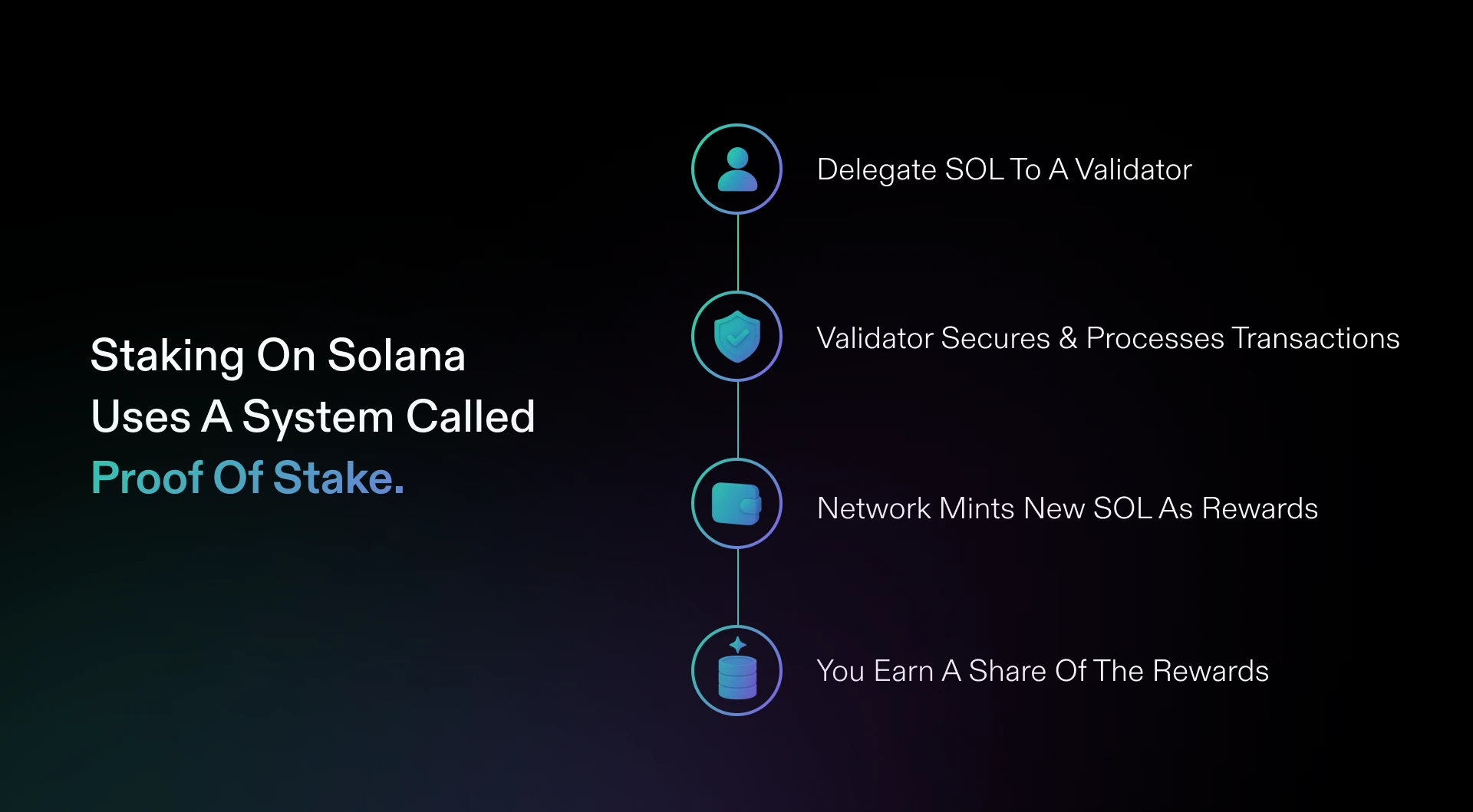

Staking flow diagram showing: Delegate SOL to validator, validator processes transactions, network mints rewards, you earn share

Staking flow diagram showing: Delegate SOL to validator, validator processes transactions, network mints rewards, you earn share

Staking on Solana uses a system called Proof of Stake:

- You delegate SOL to a validator of your choice

- Validators process transactions and secure the network

- The network creates new SOL as rewards

- You earn a share of these rewards

Your SOL never leaves your wallet - you're simply giving a validator permission to use it as part of their stake.

Why Networks Need Staking

Staking serves important purposes:

Network Security

Validators must stake SOL as collateral. If they misbehave, they risk losing their stake. This economic incentive keeps validators honest.

Decentralization

Having many validators worldwide makes the network resilient. No single entity controls transaction processing.

Sustainable Rewards

Unlike mining, staking doesn't require expensive hardware or high energy consumption. Rewards come from network inflation designed to secure the network long-term.

Getting Started with Staking

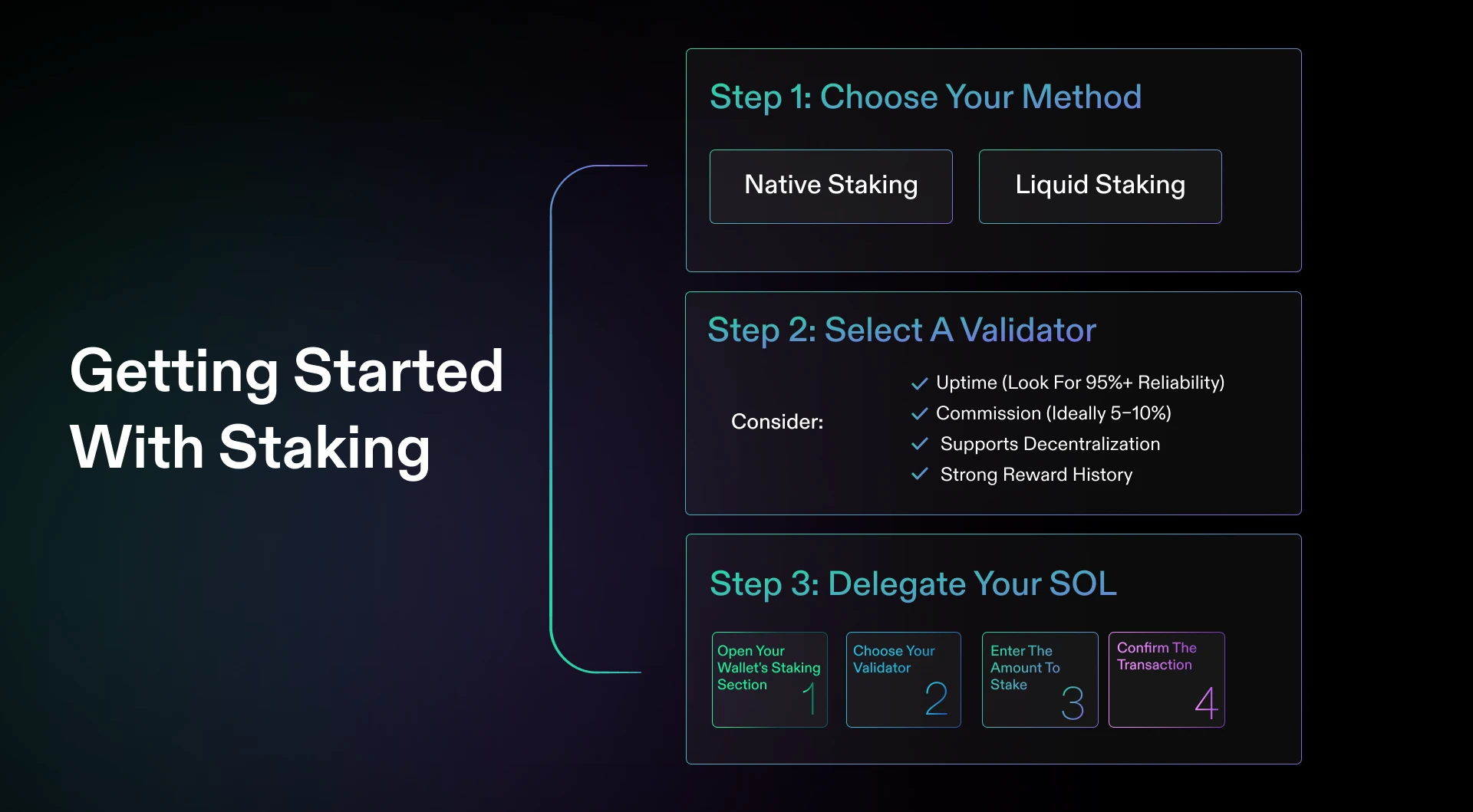

Step-by-step staking guide: Choose method (Native or Liquid), Select validator, Delegate your SOL through wallet

Step-by-step staking guide: Choose method (Native or Liquid), Select validator, Delegate your SOL through wallet

Step 1: Choose Your Method

Native Staking (Recommended for beginners)

- Stake directly from your wallet

- Full control over your SOL

- 2-3 day unstaking period

- Earn 5-7% APY

Liquid Staking

- Receive tokens representing your staked SOL

- Use these tokens in other applications

- Instant liquidity

- Slightly lower rewards due to fees

Step 2: Select a Validator

Consider these factors when choosing:

- Uptime: How reliably they stay online (aim for 95%+)

- Commission: Fee they charge (typically 5-10%)

- Size: Supporting smaller validators helps decentralization

- Performance: How many rewards they've earned historically

Step 3: Delegate Your SOL

- Open your wallet's staking section

- Choose your validator

- Enter the amount to stake

- Confirm the transaction

Your SOL remains in your control throughout this process.

Understanding Rewards

How Rewards Work

- Current rate: ~5-7% annually

- Paid every epoch (~2-3 days)

- Automatically compounded if left staked

- Rewards come from network inflation

Example Calculation

If you stake 1,000 SOL at 6% APY:

- Annual rewards: ~60 SOL

- Monthly rewards: ~5 SOL

- Per epoch: ~0.5 SOL

Managing Your Stake

Adding More SOL

You can add to your stake anytime. New SOL starts earning immediately.

Unstaking Process

- Request unstaking in your wallet

- Wait 2-3 days (cooldown period)

- Withdraw your SOL

This delay protects network stability but means you can't access funds immediately.

Switching Validators

You can redelegate to a different validator without unstaking. This helps if your validator's performance declines.

Liquid Staking Options

Comparison of Native Staking vs Liquid Staking showing key differences and benefits

Comparison of Native Staking vs Liquid Staking showing key differences and benefits

Liquid staking protocols offer flexibility:

How It Works

- Deposit SOL into the protocol

- Receive liquid staking tokens (like mSOL or stSOL)

- Use these tokens while still earning staking rewards

- Exchange back for SOL plus rewards anytime

Trade-offs

Pros:

- Immediate liquidity

- Use staked value in DeFi

- No unstaking period

Cons:

- Small protocol fees

- Additional smart contract risk

- Slightly lower yields

Important Considerations

Risks

- Validator performance: Poor validators mean fewer rewards

- Opportunity cost: Your SOL is locked during unstaking

- No slashing currently: Unlike some networks, Solana doesn't currently penalize validators by taking their stake

Tax Implications

Staking rewards may be taxable income in your jurisdiction. Keep records and consult tax professionals.

Best Practices

- Start with a small amount to learn

- Diversify across multiple validators

- Monitor validator performance periodically

- Consider liquid staking for flexibility

Common Questions

Is staking safe?

Your SOL never leaves your wallet. The main risk is choosing a poor-performing validator, which affects rewards but not your principal.

Can I lose my staked SOL?

Currently, Solana doesn't have slashing (penalty for validator misbehavior). Your main risk is missing rewards from poor validator performance.

How often are rewards paid?

Rewards accumulate every epoch (approximately 2-3 days) and are automatically compounded.

What's the minimum to stake?

There's no network minimum, but some wallets may have small minimums (often 1 SOL or less).

What's Next

Now that you understand staking, you're ready to learn about tokens on Solana. The next chapter explores how different types of tokens work and what you can do with them.

Remember: staking is a long-term strategy for earning rewards while supporting network security. Start small, choose validators carefully, and let compound interest work for you.